The Pros, Cons and Everything You Need to Know About Making Your Blog Your Business

Treat your blog like a business.

You hear it nonstop. From peers. At conferences. During podcasts. On other blogs. From us.

A lot of people like the idea of treating their blog like a business, but they aren't sure how to make the transition from hobby blogger to business owner.

One of your first steps should be to consider whether or not it makes sense for you to incorporate your business. After you learn about the benefits of incorporation, you need to decide which business structure makes the most sense for you.

Because forming a business has both legal and tax implications, we recommend that you consult with an accountant and a lawyer to ensure that you are picking the best structure for your business and personal circumstances.

Now, let's review the most common business structures.

Sole Proprietor

If you decide to run your blog as a business, with you as the sole owner, and you haven't filed any paperwork with the Secretary of State, you are a sole proprietor.

Pros of Sole Proprietorship for Bloggers:

- No specific paperwork or fees to be a sole proprietor

- You are in control of your business with no other shareholders or directors

Cons of Sole Proprietorship for Bloggers:

- You may still need to file for a business license. You can check here to see if your state requires a business license.

- If you are using a different name for your business (other than your own name), you will need to file a DBA. (See below.)

- You will be liable for all assets and liabilities of your company. For example, if your company were to be sued, you would personally be responsible for any judgment against your company and your personal assets could be seized. (Yes, that means your house, car, or bank accounts.)

General Partnership

If your business has two or more people sharing ownership, it's a partnership. This is comparable to a sole proprietorship in many ways.

Pros of Partnerships for Bloggers:

- It's generally less expensive to file for a partnership than another type of entity.

- You share the financial commitment with another person.

Cons of Partnerships for Bloggers:

- You will still need to file and obtain any necessary licenses.

- You would need to file for your DBA.

- You and your partner are equally liable (unless otherwise agreed to in writing) for all assets and liabilities.

DBA

We are regularly asked about whether a blogger needs to file for a DBA, which stands for “doing business as.” This type of filing is typically called a fictitious name registration (but the phrasing may vary depending on where you live). Generally, this is used when your business has a different name than the entity that owns the business. For example, if you are Joe Smith and your blog is named Smithtastic Smoothies, you would want to file for a DBA as Smithtastic Smoothies.

While a DBA is generally something that you will need if the name differs, it does not take the place of a business license for a sole proprietor. Be sure to check your local regulations to ensure you've completed any necessary filings.

C Corp

A C Corp is a corporation, which is an entity owned by shareholders.

Pros of the C Corp for Bloggers:

- Shareholders are not personally liable for the debts of a C Corp.

- Ability to raise revenue through the sale of stock.

Cons of the C Corp for Bloggers:

- All corporations must be organized and filed with the Secretary of State.

- Corporations are highly regulated and require more formalities than other structures. Shareholders elect directors and the directors appoint the officers of the corporation.

- Annual board and shareholder meetings (and corresponding minutes of those meetings) are required.

S Corp

Legally, an S Corp is still a corporation, like a C Corp; however, an S Corp is a special designation with the IRS to receive different taxation than a C Corp. We recommend talking with your accountant to see if the method of taxation used for an S Corp makes sense for you personally.

And, if you decide that you prefer the LLC as your legal business structure, you can still elect to have your LLC taxed as an S Corp.

LLC

An LLC is a limited liability company, which offers many of the benefits of a corporation (limited liability) without the same formalities of a corporation. Taxation is also handled differently.

Pros of the LLC for Bloggers:

- Governed by LLC Members

- Typically, members are not liable for the LLC's debts.

- Fewer formalities than a corporation.

Cons of the LLC for Bloggers:

- Annual filings required through the Secretary of State.

- May be less desirable if you are seeking funding because you can't issue shares of stock.

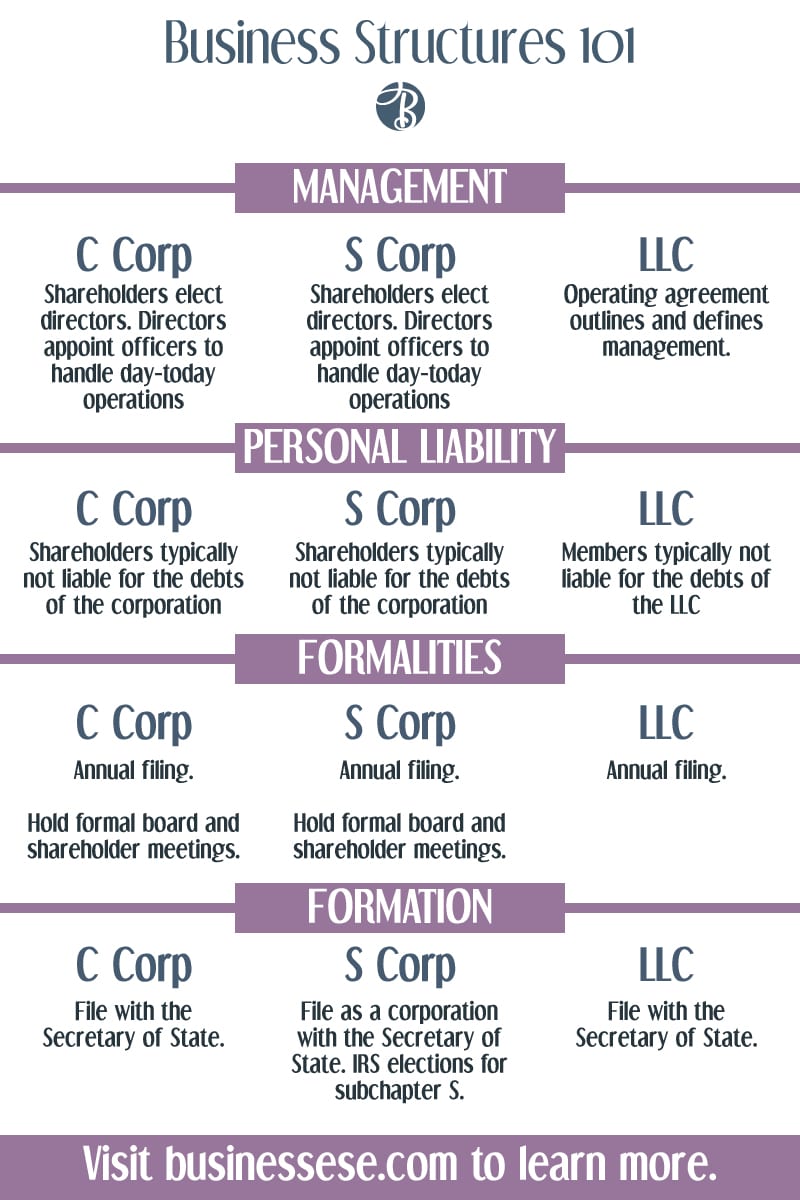

Most frequently, bloggers debate between an LLC, a C Corp, and an S Corp. Here's a side-by-side comparison of some of the features of each structure.

One thing that you should keep in mind is that, legally, an S Corp will be comparable to a C Corp.

Which form is best for YOUR business?

It will ultimately be up to you to decide which structure is best for your business. Bloggers decide to set up their business structure for a lot of reasons, but most commonly, we hear that people want to ensure that their personal assets are protected. Usually, when we talk with people, they are debating between an S Corp or an LLC.

Typically, we recommend an LLC for bloggers since it is easy to set up and requires fewer corporate formalities. Plus, and often most importantly, an LLC will give you the limited liability that you want without many of the hassles that go along with a C Corp.

But remember, talk to your CPA and lawyer first to make sure you have considered this from all angles.

Further reading: what to do after you incorporate.